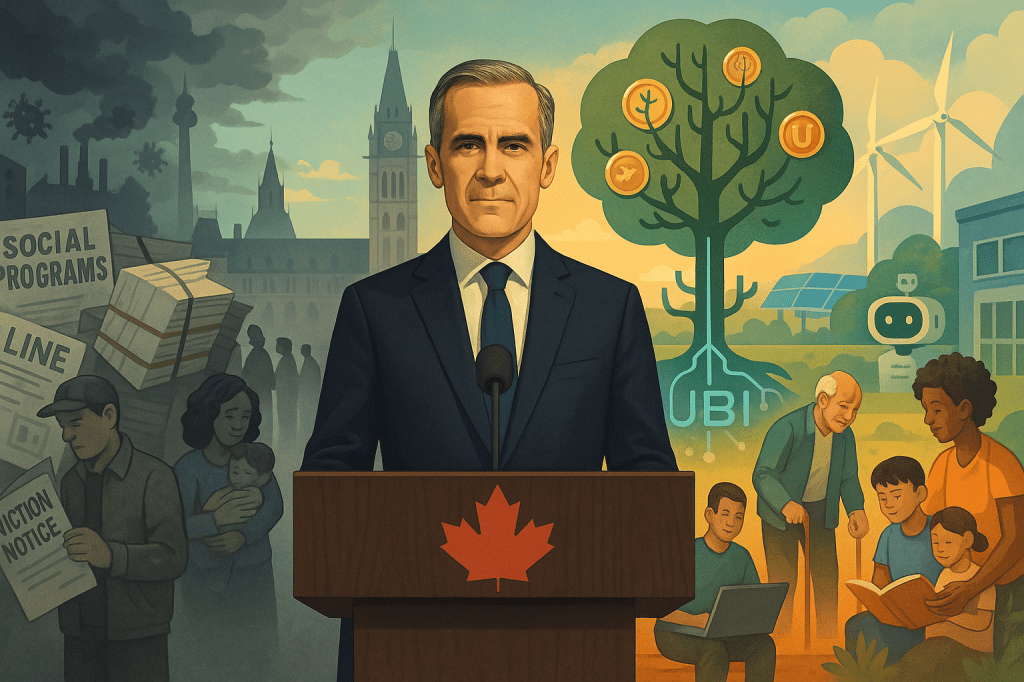

The election of Mark Carney as Canada’s new Prime Minister marks more than a changing of the guard, it signals a chance to transform how we think about economic justice, social policy, and the role of government in a post-pandemic, post-carbon, AI-disrupted world. Yet, if this new Liberal administration wants to do more than manage decline or tinker at the edges, it must champion Universal Basic Income (UBI), and it must do so within this first term.

To skeptics, the usual pushback is cost. “We can’t afford it.” But what if I told you we can, without adding a cent to the deficit?

A bold, revenue-neutral UBI is not only possible, it’s the smart, responsible, and forward-thinking choice. It would simplify our bloated patchwork of social programs, reduce inequality, and stabilize the economy, all while respecting fiscal realities. Carney, with his reputation for monetary prudence and social conscience, is uniquely positioned to make this happen.

The Case for UBI, Now More Than Ever

We live in precarious times. AI and automation are displacing jobs once thought secure. The gig economy has redefined work for an entire generation, offering flexibility but no stability. Climate change is reshaping our industries, economies, and communities. And regional inequalities, from rural depopulation to urban housing crises, are deepening social division.

UBI provides a powerful, simple solution: a no-strings-attached income that ensures every Canadian can meet their basic needs, make real choices, and live with dignity. No complex eligibility criteria. No stigma. Just a stable foundation for all.

This isn’t a call for endless spending. This is a plan for smart reinvestment, one that replaces outdated, fragmented systems with a coherent, efficient, and humane approach.

Revenue-Neutral UBI: A Practical Path

The key to political and economic viability is fiscal neutrality. Here’s how we get there:

Streamline the Social Safety Net

Our current welfare architecture is costly, overlapping, and often punitive. We propose replacing core income support programs, provincial social assistance, EI for low-wage workers, and a range of targeted income-tested tax credits, with a single, universal UBI. This simplification reduces administrative duplication and restores dignity to recipients.

Rethink OAS and GIS

These seniors’ programs already operate as a basic income for the elderly. By integrating them into a universal model, with UBI replacing these benefits for most, but supplemented by needs-based top-ups for seniors with unique medical or housing costs, we ensure fairness without duplication.

Restructure (Not Eliminate) CPP

CPP remains essential as a pension earned through contribution, but some recalibration of contribution thresholds and benefit tiers, alongside UBI, can reduce reliance on inflated public pensions to cover basic needs, while preserving the contributory principle.

Modest, Targeted Tax Reform

To close the revenue loop, introduce a small surtax (e.g., 2%) on individual incomes over $150,000, and slightly increase capital gains inclusion rates. These are not radical measures, they simply ask the wealthiest Canadians to help ensure every citizen has a secure foundation. For 95% of taxpayers, no increase would be necessary.

Numerous economic models (including work by Evelyn Forget, UBC’s Kevin Milligan, and CCPA researchers) show that a well-designed UBI can be nearly or entirely self-funding when paired with smart policy adjustments like these.

Political Opportunity and Liberal Legacy

Prime Minister Carney doesn’t need to look far for historical inspiration. Universal healthcare, bilingualism, the Charter, these were all ambitious Liberal achievements once considered politically risky and fiscally daunting, yet they reshaped Canada.

UBI can be his legacy. It would resonate across voter blocs: rural Canadians seeking stability, urban millennials burdened by debt and housing costs, women and caregivers locked out of full-time work, and gig workers with no safety net. It’s a unifying policy in a fragmented nation.

Moreover, by leading with a revenue-neutral model, Carney can neutralize opposition from deficit hawks and centrists, while winning support from social democrats, Indigenous leaders, environmentalists, and the entrepreneurial class alike.

A Step-by-Step Roadmap

- Launch a National UBI Task Force in the first 100 days, chaired by experts in economics, social policy, and Indigenous governance.

- Table a UBI White Paper by the end of Year 1, outlining fiscal models, legal changes, and implementation scenarios.

- Pilot the program in a representative region (e.g., Northern Ontario, Atlantic Canada, or an urban-rural mix) with independent evaluation.

- Introduce legislation in Year 3, with phased implementation beginning before the 2029 election.

This is not pie-in-the-sky. This is responsible governance meeting bold vision.

The Values We Must Uphold

UBI is about more than money, it’s about modernizing our social contract. It says to every Canadian: you matter. You are not a cost, a case file, or a problem to manage. You are a citizen with rights, worth, and potential.

Mr. Carney, you’ve spoken eloquently about “values-based capitalism” and “inclusive transitions.” UBI is the policy vehicle that delivers on those values. And by designing it to be fiscally neutral, you can bring the skeptics along without compromising ambition.

Now is the time to lead not just with caution, but with courage. We can afford Universal Basic Income, not in spite of economic constraints, but because of them.

Let’s stop managing poverty. Let’s start guaranteeing security. Let’s build a Canada where no one is left behind.