It was only a matter of time before Canada threw its toque into the ring on the global debate over taxing tech giants. After years of polite patience, Ottawa finally said enough is enough and committed to implementing a Digital Services Tax (DST), retroactively, no less, dating back to January 1, 2022. The goal? To make Big Tech pay its fair share for the billions they earn from Canadians’ online clicks, swipes, and searches. Predictably, this move hasn’t exactly gone down well south of the border, especially with Donald Trump, who’s already threatening retaliatory tariffs faster than you can say “Google it.”

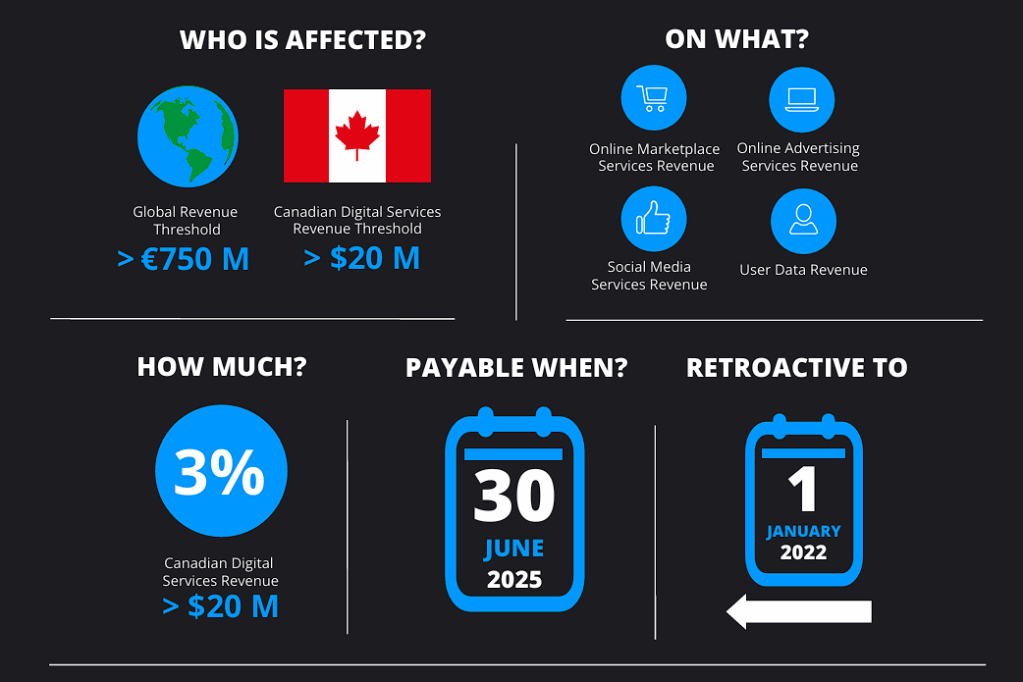

Canada’s DST is a 3% levy on revenues from digital services; think online marketplaces, advertising platforms, and social media, that target Canadian users. The tax only kicks in for companies making over €750 million globally and more than $20 million in Canadian digital revenues. So, yes, this is about Amazon, Google, Meta, and Apple. Not your cousin’s Shopify side hustle.

The reasoning behind the move is, frankly, hard to argue with. For years, digital multinationals have made huge profits in countries where they have lots of users but no physical offices. Since our tax codes were written in the days of rotary phones, these companies have legally side-stepped corporate taxes in places like Canada while hoovering up data and ad dollars with industrial-grade efficiency. The DST is intended as a band-aid solution until a global fix comes together, though that band-aid is now being applied with an increasingly firm hand.

In truth, the global tide may finally be turning on Silicon Valley’s long, tax-free world tour. For over a decade, Big Tech has surfed a wave of international growth, scaling into nearly every market on Earth without paying local dues. Armed with sophisticated tax avoidance schemes, usually routed through Ireland or the Netherlands, the giants of the digital economy have profited handsomely while governments watched domestic retailers struggle to compete. But now, faced with growing public backlash and creaking public coffers, countries from France to India to Canada are drawing a line. The message is clear: if you make money off our citizens, you’re going to help fund the roads, schools, and social programs that keep them clicking.

The global fix in question is the OECD’s “Two-Pillar” solution, a diplomatic marathon attempting to modernize international tax rules. Pillar One aims to reallocate taxing rights to market countries (like Canada), while Pillar Two would establish a global minimum corporate tax of 15%. Canada has said it would delay DST collection if the OECD deal is implemented, but with the U.S. dragging its heels on ratification, Ottawa is preparing to go it alone.

That’s where Trump comes in. Never one to let a perceived slight slide, he’s treating Canada’s DST as a direct assault on U.S. interests. After all, the companies getting dinged are almost entirely American. Trump’s threats to slap retaliatory tariffs on Canadian exports are classic “America First” bluster, but they’re not without precedent. The U.S. already opened Section 301 investigations into several other countries’ DSTs, accusing them of unfairly targeting American firms. Biden’s administration cooled the rhetoric, but the sentiment remains.

Of course, Canada isn’t the only country to stick its neck out on this. France was the pioneer, pushing ahead with a 3% DST despite fierce U.S. pushback. Italy, Spain, and the UK followed suit. Even India got into the act with its “equalisation levy,” predating many Western attempts. Each of these nations, like Canada, grew tired of waiting for multilateral action while Silicon Valley giants dodged their tax nets with Olympic-level agility.

Interestingly, not everyone in the Anglosphere has been quite so bold. Take Australia. A few years back, it flirted with a DST, there were consultations, white papers, and worried glances toward Washington. But ultimately, Canberra decided to give the OECD process a shot and beefed up its anti-avoidance laws instead. Its Multinational Anti-Avoidance Law and Diverted Profits Tax now let the tax office go after digital firms that try to shuffle profits offshore. It’s the equivalent of hiring a tough new accountant rather than inventing a new tax altogether.

New Zealand, meanwhile, has taken a “just in case” approach. Legislation for a 3% DST was passed in 2023, but it’s sitting in a drawer for now, ready to go if the OECD talks collapse. The Kiwis have been clear they don’t want to pull the trigger unless absolutely necessary, probably because they’d prefer not to find themselves on the receiving end of a tweetstorm or tariff tantrum from the next American administration.

So here we are: Canada, gloves off and calculator in hand, is forging ahead, determined to claw back a fair share from the tech titans. Australia and New Zealand, pragmatic as ever, are hedging their bets and keeping trade relationships intact, at least for now. But even their patience has limits. The longer the OECD deal stalls, the more tempting it becomes to follow Canada’s lead.

In the end, this is a fight not about code or commerce, but about fairness in the digital age. The world’s tax systems were built for an era of railroads and oil refineries, not cloud storage and influencer revenue. Until the global rules catch up, expect more countries to test their own digital tax solutions. Whether that means poking the American bear or just poking around in policy drawers remains to be seen. But one thing’s certain: tech giants might finally be running out of places to hide.