Canada is entering a new phase of nation-building, one that blends urgent economic needs with longer-term structural transformation. Under Prime Minister Mark Carney, the government has moved decisively to put infrastructure back at the centre of Canadian economic policy. The legislative and programmatic architecture that has been put in place in 2025 reveals not only a desire to build quickly, but also a strategy to re-shape the foundations of trade, energy, housing, and Arctic sovereignty. The pattern of investment and institution-building shows a layered approach: short-term relief to pressing bottlenecks, medium-term positioning of Canada as a reliable trading partner and energy supplier, and long-term steps to reinforce sovereignty, climate resilience, and competitiveness.

At the core lies the One Canadian Economy Act, passed in June 2025, which dismantles federal barriers to interprovincial trade while creating the Building Canada Act. This framework enshrines the ability to designate projects of “national interest” for streamlined approval. The intent is clear: Canada cannot afford to have critical transmission lines, export terminals, or transportation corridors stalled indefinitely in regulatory gridlock. To operationalize this authority, the government launched a Major Projects Office (MPO), with an Indigenous Advisory Council integrated into its structure. The MPO serves as a single-window permitting and financing hub, designed to shepherd nation-building projects through approvals in under two years. The short-term gain is administrative clarity and accelerated approvals; the medium-term payoff is a pipeline of projects that directly enhance trade capacity and energy reliability.

Housing has been treated with equal urgency. The creation of Build Canada Homes, announced in the May Throne Speech and detailed in August, signals a willingness to intervene directly in housing supply. Paired with CMHC’s Housing Design Catalogue, which offers standardized blueprints for gentle density from accessory units to six-plexes, the federal role is shifting from passive funding to active delivery. Short-term gains include faster project approvals and cost savings for small-scale builders. In the medium term, Build Canada Homes intends to scale modular and prefabricated construction to double housing output, stabilizing affordability while anchoring domestic supply chains in Canadian lumber and inputs. The long-term structural effect would be the normalization of higher building rates across the country, a prerequisite for sustaining workforce mobility and economic competitiveness.

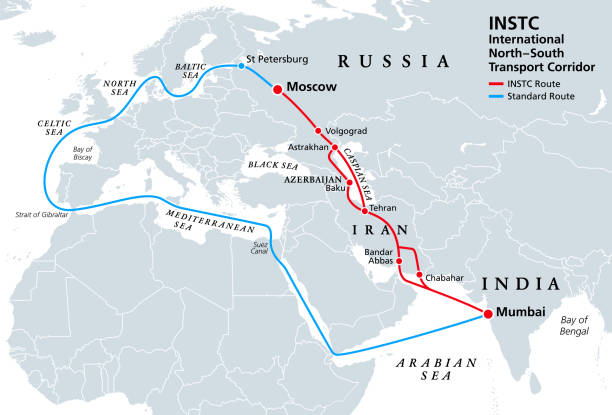

Trade and corridor infrastructure forms the third pillar. The Trade Diversification Corridor Fund, budgeted at five billion dollars, is designed to expand port and rail capacity and reduce Canada’s overreliance on U.S. gateways. The High Frequency Rail (HFR) project between Toronto, Ottawa, Montreal, and Quebec City is continuing, promising transformative improvements to the most densely populated corridor. In the short run, HFR stimulates engineering and pre-construction employment. Medium-term gains will appear in reduced congestion, faster business travel, and increased regional integration. The long-term dividends include lower emissions and globally competitive connectivity between Canada’s political and financial capitals.

The expansion of the Port of Churchill in northern Manitoba illustrates how the government is aligning regional development with national strategy. With over $175 million in new federal funding, $36 million from Manitoba, and parallel commitments from Saskatchewan, Churchill is being re-equipped as a trade-enabling Arctic gateway. Recent investments in rail reliability, storage capacity for minerals, and new wharf facilities are positioning it as a potential hub for agricultural exports and critical minerals. The short-term impact is the stabilization of Hudson Bay Railway service, critical for northern communities. The medium-term benefit is expanded shipping capacity during the navigable season. The long-term prize lies in climate-extended Arctic navigation, which could turn Churchill into a permanent transatlantic container port, reshaping Canada’s role in global shipping.

Energy and clean industrial infrastructure represent another strategic frontier. Through the Canada Growth Fund (CGF), Ottawa is deploying $15 billion to de-risk large low-carbon projects, with seven billion earmarked for carbon contracts for difference. This mechanism gives investors certainty that carbon pricing will not collapse, unlocking private capital for carbon capture, hydrogen, and industrial decarbonization. Short-term benefits include early project commitments, such as waste-to-energy facilities in Alberta. Medium-term, these contracts build a domestic market for clean technologies and expand Canada’s share in global green supply chains. Long-term, CGF instruments lay the foundation for a carbon-competitive industrial economy, ensuring Canadian heavy industry remains viable under international climate rules.

The Arctic and defence agenda provides a parallel set of strategic investments. NORAD modernization, including the joint development of over-the-horizon radar with Australia, directly strengthens northern surveillance. The Canadian Patrol Submarine Project, with three bidders shortlisted, will anchor significant industrial activity in Canadian shipyards. In the short run, these procurements inject capital into defence industries. Medium-term gains include jobs, technology transfer, and new capacity in coastal infrastructure. The long-term effect is reinforcement of Arctic sovereignty and continental security at a time of intensifying geopolitical competition.

Underlying all of this is continuity through existing transfers such as the Canada Community-Building Fund, which locks in $26.7 billion for local water, transit, and road projects through 2034. These represent the essential backbone investments that ensure communities can absorb population growth and remain livable, complementing the marquee projects at the national level.

Taken together, these initiatives reveal a strategy that is both defensive and offensive. In the short term, Canadians will see more housing starts, more shovels in the ground for rail and port expansions, and more certainty for clean-tech investors. Over the medium term, the country will gain diversified trade routes, a more mobile workforce, and scaled-up housing supply that cools inflationary pressures. In the long run, the institutional innovations of 2025, the One Canadian Economy Act, the Major Projects Office, and the Canada Growth Fund, may be remembered as the architecture that enabled Canada to hold its ground as a sovereign, competitive, and sustainable economy in a fracturing world.