Pierre Poilievre has finally proposed a plan to address the Trump administration’s February 2025 tariffs, seemingly based on an International Monetary Fund (IMF) report. This raises the question: what progress has Canada made on internal trade barriers in response to the IMF’s findings, and what still needs to be done?

Over the past five years, Canada has tackled some of the regulatory and geographic hurdles that have long hindered economic efficiency. The 2019 IMF report highlighted these four barriers—regulatory fragmentation, restrictive provincial controls on goods like alcohol, technical inconsistencies in industry standards, and vast geographic challenges. While reforms have occurred, largely under the Canadian Free Trade Agreement (CFTA), major inefficiencies remain.

The COVID-19 pandemic underscored the fragility of Canada’s fragmented market, prompting temporary regulatory flexibility. Licensing restrictions were eased for healthcare workers, and supply chain barriers were lifted to prevent shortages. This period proved that interprovincial trade barriers could be swiftly reduced when necessary. Yet, once the crisis subsided, most provinces reinstated pre-pandemic restrictions, missing an opportunity for lasting reform.

The CFTA, in place since 2017, has encouraged regulatory alignment, particularly in vehicle weight standards, and professional certifications. However, progress has been slow, with key industries such as construction, trucking, and food processing still burdened by differing provincial rules. One of the more visible steps forward has been the relaxation of alcohol trade restrictions. In 2018, provincial premiers agreed to lift some limits on interprovincial alcohol transportation, while trying to address the mixed market of monopolistic liquor boards and private sector businesses.

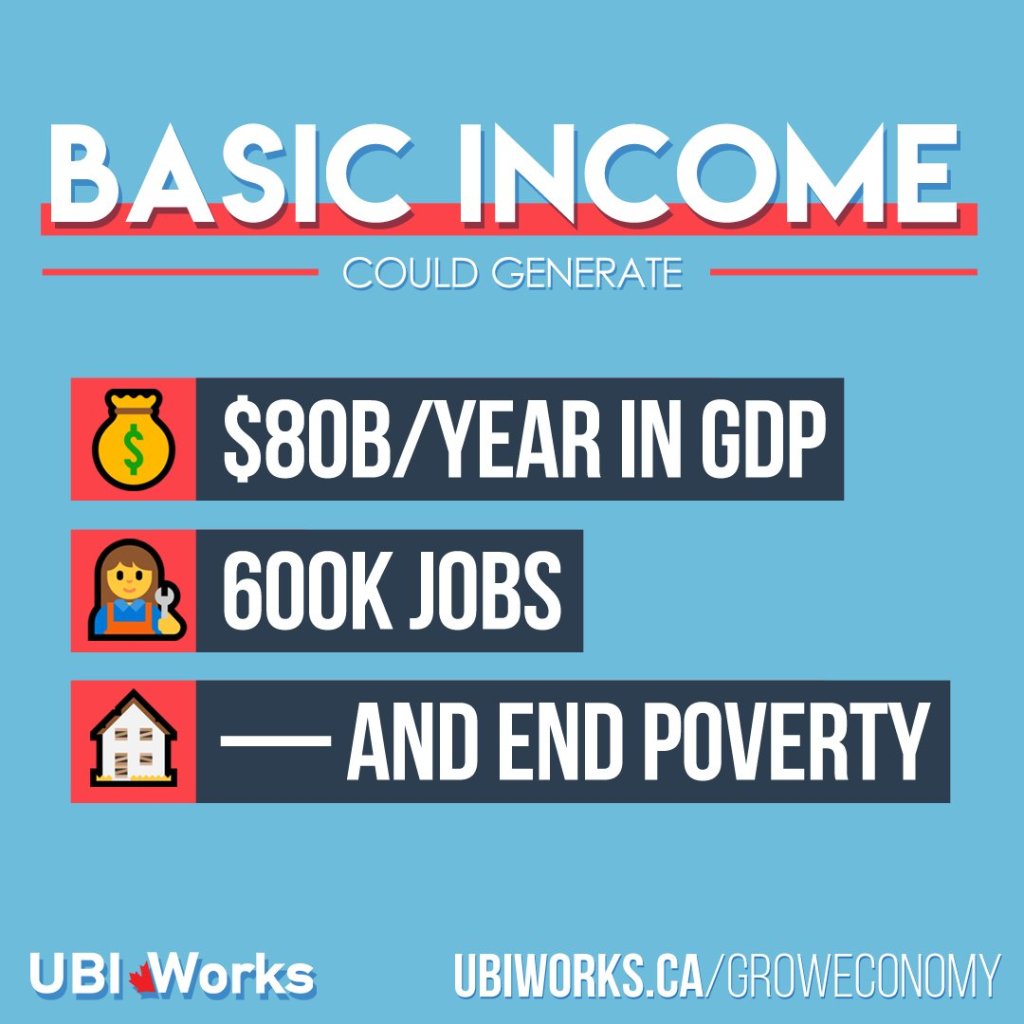

The economic potential of eliminating these barriers is staggering. A report commissioned by Alberta’s government found that mutual recognition across provinces could boost GDP by up to 7.9%, adding as much as $200 billion annually. Internal Trade Minister Anita Anand reinforced this in a January 2025 CBC interview, stating that reducing trade barriers “could lower prices by up to 15 per cent, boost productivity by up to seven per cent, and add up to $200 billion to the domestic economy.” Yet, political inertia and regional protectionism have stalled deeper reforms.

In the short to medium term, Canada must prioritize mutual recognition agreements to streamline licensing and regulatory requirements. The construction industry, for example, faces costly delays due to inconsistent building codes across provinces—an easily fixable issue. Beyond regulatory alignment, reducing paperwork and red tape, particularly for small and medium-sized enterprises, would remove unnecessary friction from the system. A Federal-Provincial-Territorial (FPT) taskforce focused on simplifying these processes, combined with digital infrastructure investments for e-licensing, could provide meaningful relief.

Addressing natural barriers is a longer-term challenge, but progress is possible. Expanding interprovincial transportation networks and improving digital connectivity in rural areas would allow businesses to access larger markets more efficiently.

Ultimately, Canada needs sustained political will to drive internal trade reform. While agreements like the CFTA have laid the groundwork, stronger enforcement mechanisms, and a shift away from provincial protectionism are required. If provinces remain uncooperative, federal intervention may become necessary to unlock the full economic potential of a truly open market. Canada cannot afford to let bureaucratic inertia continue to suppress its economic growth.