On September 18, 2025, Canadian Prime Minister Mark Carney and Mexican President Claudia Sheinbaum signed a comprehensive strategic partnership in Mexico City. This agreement, covering 2025–2028, aims to deepen economic, security, and environmental collaboration between Canada and Mexico, explicitly anticipating the 2026 review of the United States-Mexico-Canada Agreement (USMCA). While the immediate bilateral effects are evident, the agreement also carries broader implications for the three major North American economies: Canada, Mexico, and the United States.

Scope and Focus of the Agreement

At its core, the agreement establishes a four-year bilateral action plan encompassing four pillars: prosperity, mobility and social inclusion, security, and environmental sustainability. Economically, it focuses on expanding trade and investment in infrastructure, energy, agriculture, and health, while jointly developing critical infrastructure such as ports, rail links, and energy corridors. In security, it aims to strengthen border control and combat transnational crime. The environmental and sustainability component is particularly notable, signaling both countries’ intent to collaborate on climate mitigation and resource management.

Strategic Context

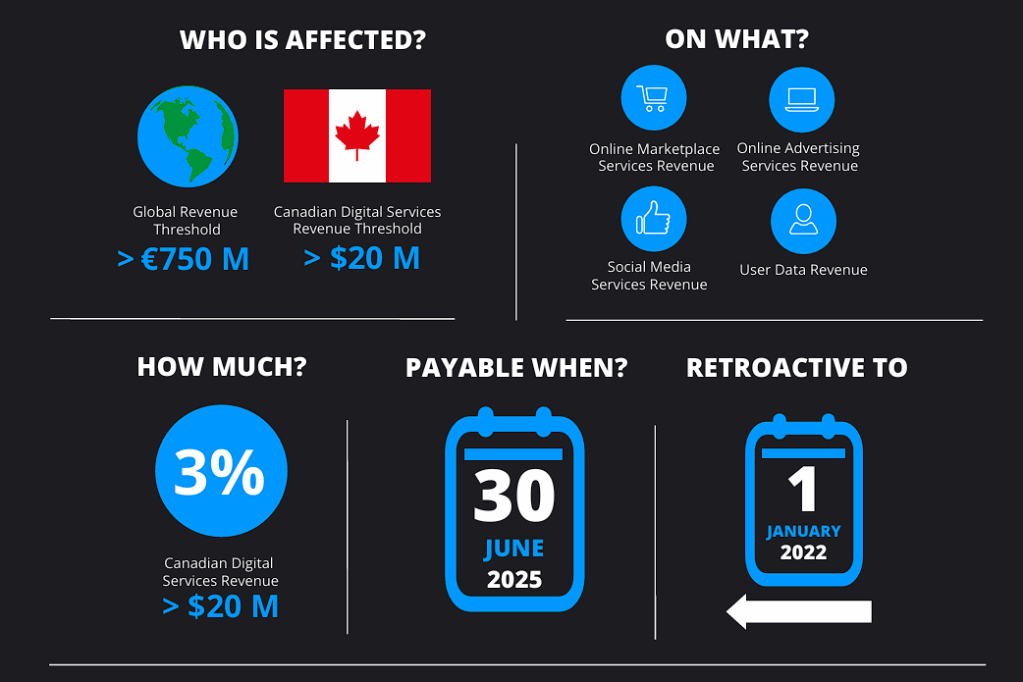

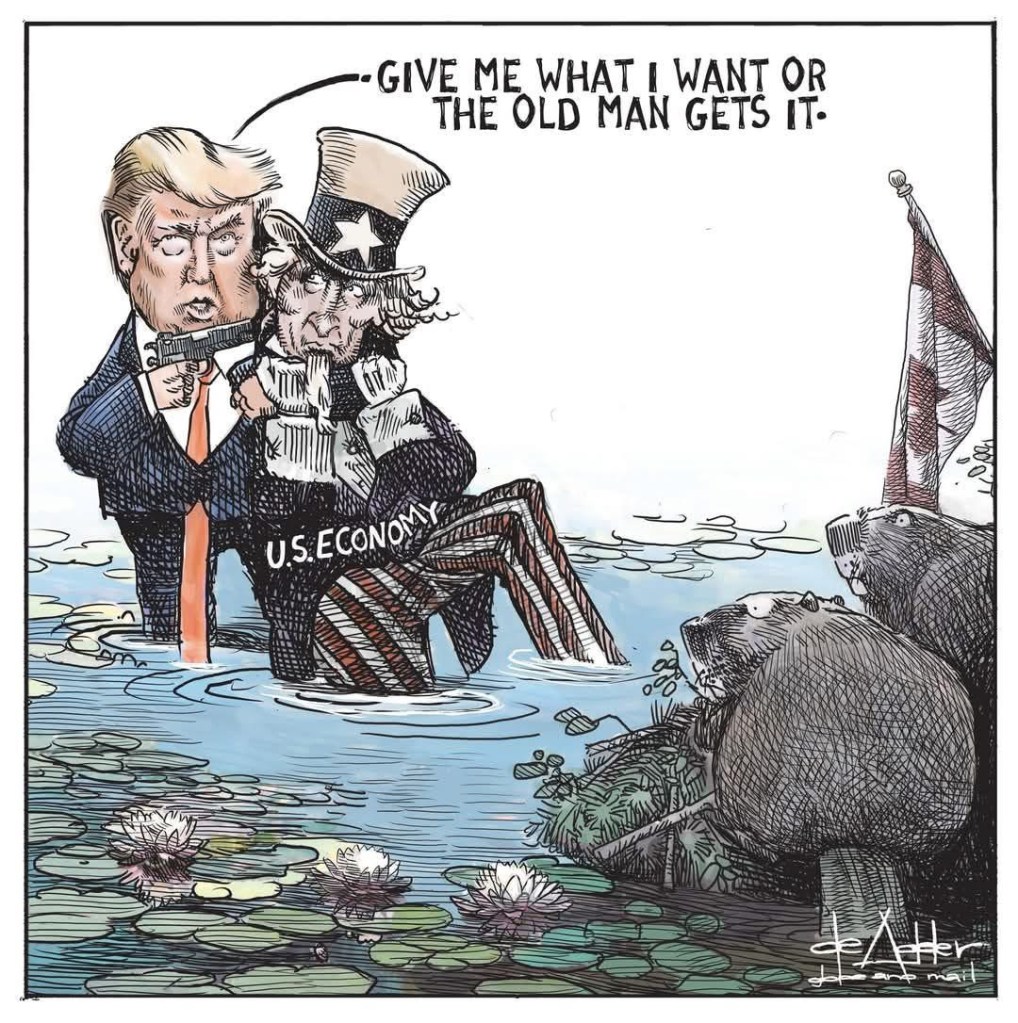

The timing of this agreement is significant. Earlier in 2025, both Canada and Mexico faced tariffs and trade frictions with the United States, creating a strategic impetus to solidify bilateral cooperation. This partnership may serve as a hedge against future unilateral U.S. trade measures and positions both nations more strongly for upcoming negotiations surrounding the USMCA review in 2026. By consolidating economic, security, and environmental frameworks bilaterally, Canada and Mexico signal that they can act decisively and collaboratively independent of U.S. alignment, while still committing to trilateral engagement.

Implications for Canada

For Canada, the agreement represents a proactive diversification of trade and investment partnerships within North America. Beyond the U.S., Mexico is an increasingly significant market for Canadian goods and services, particularly in energy and infrastructure. By reinforcing bilateral economic ties, Canada gains leverage in upcoming USMCA discussions and reduces its vulnerability to unilateral U.S. trade policy shifts. Moreover, collaboration on climate and sustainability initiatives positions Canada as a leader in cross-border environmental governance, complementing its domestic commitments.

Implications for Mexico

For Mexico, the agreement strengthens its economic and geopolitical options. Mexico has historically balanced trade and diplomatic relationships with the United States while seeking alternative partners. Formalizing a strategic partnership with Canada enhances Mexico’s negotiating position with the U.S., particularly as the USMCA review approaches. Joint infrastructure projects and investment commitments also promise to accelerate Mexico’s industrial and energy development, potentially boosting domestic employment and technology transfer.

Implications for the United States

For the United States, the Canada-Mexico agreement presents both opportunities and challenges. On one hand, stronger integration between Canada and Mexico may facilitate smoother trilateral cooperation, reducing friction in cross-border commerce and security. On the other hand, it could limit U.S. leverage in bilateral negotiations with either country if Canada and Mexico present unified positions during the USMCA review. The U.S. may need to consider the strategic consequences of any unilateral trade actions in light of this growing North American solidarity.

The Canada-Mexico strategic partnership represents a calculated, forward-looking approach to regional stability and prosperity. While the agreement strengthens bilateral ties, it also reshapes the dynamics of North American relations, providing both Canada and Mexico with enhanced economic and strategic agency. For the United States, it signals a more integrated northern and southern neighbor bloc, emphasizing the importance of collaborative rather than confrontational engagement. As the 2026 USMCA review approaches, all three nations will likely navigate a more complex and interdependent landscape, where trilateral cooperation becomes not only beneficial but essential.

Sources:

• Reuters. Canada and Mexico committed to shared partnership with US, Carney says. September 18, 2025. link

• Politico. Mexico and Canada make nice ahead of high-stakes trade talks. September 18, 2025. link

• Global News. Carney, Sheinbaum sign strategic partnership to boost trade, security, environment. September 18, 2025. link